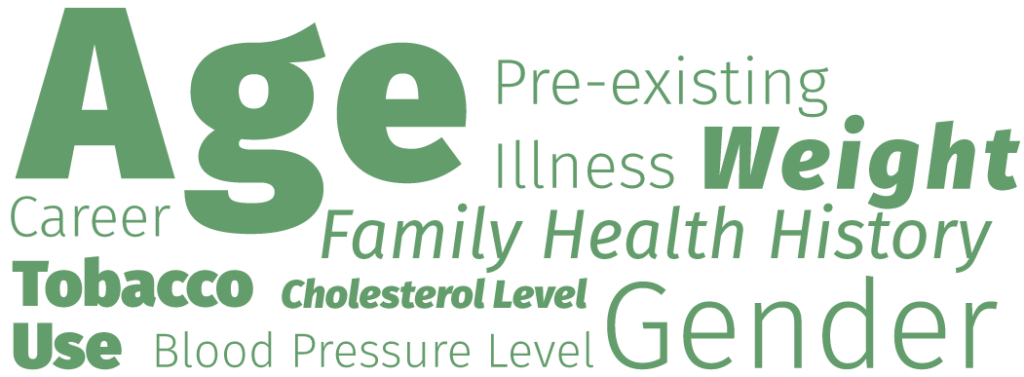

What Affects Life Insurance?

Life insurance plans are not a one size fits all.

Figure out your needs and what is important to you.

Term Life Insurance

Amount of Time

Term coverage for a fixed amount of time and expires after allotted time is ended. Example: 10, 20, or 30 years.

Benefits

Some term life insurance policies offer options to renew or convert to whole life.

Cost

Average annual costs for term life insurance on a 20-year, $250,000 coverage plan, assuming good health:

| Costs as low as... | Male | Female |

|---|---|---|

| 25 Years Old | $16.06/mo | $13.67/mo |

| 45 Years Old | $32.67/mo | $25.79/mo |

| 65 Years Old | $229.90/mo | $160.82/mo |

Term is significantly cheaper in annual costs compared to whole life insurance plans. This is mainly because whole life insurance has cash value and can be used as a loan throughout your life for other financial emergencies or purposes.

Whole Life Insurance

Premium costs differ based on multiple variables. Contact Dale for your quote today. 435-817-0188

Amount of Time

Whole life insurance (permanent) covers you for your lifetime.

Benefits

Whole life insurance helps you builds cash and investment value against which you can borrow.

Cost

Average annual costs for whole life insurance on a 20-year, $250,000 coverage plan, assuming good health:

How Much Life Insurance Do I Need?

Use the DIME Method to calculate your life insurance needs.

Debt

Any debt that remains after your death will be passed along to your family. Funeral costs should also be included in this category. Your life insurance policy should be enough to cover these costs and ease the burden on your family.

Income

Your life insurance policy needs to cover your income until your youngest child turns 18. Take the remaining amount of years until this birthday and multiply your annual income by this number. That is the amount of income your policy will need to cover.

Mortgage

If you are still paying off a mortgage on your home, you’ll need to add the remaining amount to your debt and income to be covered by your insurance policy.

Education

Have any children? If you want to send them to college, having some money to help them through should be included in your policy. The minimum amount you should budget for a four-year education at a state school is $100,000 per child. This number will get higher for private universities or out-of-state schools.

Example

John Doe wants a life insurance plan with enough coverage to protect his family. He is $20,000 in debt, makes $70,000 annually in income, and is currently paying off $150,000 on a mortgage for their home. He and his wife have three children ages 10, 12, and 15.

Financial Needs:

- Debt = $20,000

- Mortgage = $150,000

- Income = $560,000 ($70,000 x # of years until youngest turns 18)

- Education = $300,000 ($100,000 x # of children)